Posted by: Karim Ali

Coffee with Karim

8 Key Numbers Every Investor Must Know

Est. read time: 6-7 minutes

Buying an investment property in Ottawa isn’t just about finding something that looks like a good deal. The numbers tell the real story. The challenge is that a lot of people get scared off because the math seems complicated, or they aren’t sure which numbers actually matter. The good news is that most of it can be broken down pretty simply.

If you’re thinking about getting into real estate investing in Ottawa – or you’re already in the game and want to feel more confident in your decisions – here are the core financial numbers to understand.

1. Cap Rate

The Capitalization Rate (Cap Rate) tells you how strong a property is performing based on the income it produces, without considering the mortgage.

Formula:

Net Operating Income (NOI) ÷ Purchase Price

Example (Vanier Duplex):

- Total rent: $3,000/month

- Expenses (taxes, insurance, utilities where applicable, maintenance): $900/month

- Net Operating Income = ($3,000 − $900) × 12 = $25,200

- Purchase Price: $575,000

- Cap Rate: 25,200 ÷ 575,000 = 4.38%

In Ottawa, cap rates commonly range from 3.5% to 6%, depending on neighbourhood, building type, and condition. Lower cap = strong area but less cashflow. Higher cap = more cashflow but may need work or be in a less central location.

2. Cash Flow

This is the number most people care about – how much money is left each month after the mortgage and expenses.

Formula:

- Total Rent − Expenses − Mortgage Payment = Cash Flow

Example (Orleans Stacked Townhome):

- Rent: $2,150

- Condo fee: $285

- Property tax: $245

- Insurance: $65

- Mortgage: $1,450

Cash Flow: 2,150 − (285 + 245 + 65 + 1,450)

Cash Flow = $105/month

Positive cash flow is great, but even break-even can be worthwhile in strong appreciation markets like Ottawa. Just make sure you’re comfortable with it.

3. Cash-on-Cash Return

This tells you how hard your down payment is working for you.

Formula:

- Annual Cash Flow ÷ Initial Cash Invested

Example:

Annual Cash Flow: $105 × 12 = $1,260

Down Payment + Closing Costs: $115,000

CoC Return: 1,260 ÷ 115,000 = 1.09%

Some investors compare this to a GIC (currently ~4–5%).

But the key difference is that real estate also offers:

- Mortgage pay-down

- Appreciation

- Tax benefits

- The ability to add value (renos & upgrades)

So even a low CoC isn’t always a bad thing, if the overall deal makes sense.

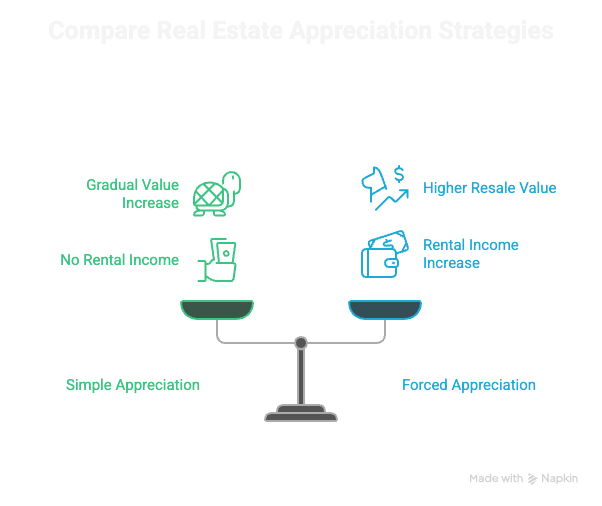

4. Appreciation vs. Forced Appreciation

Appreciation is when the market naturally increases property values over time. Ottawa has historically been stable, not wild.

Forced appreciation happens when you improve the property and raise its rental and resale value.

If you’re handy, well-networked, or patient with renovations — forced appreciation can be powerful.

5. Vacancy Rate

Ottawa generally has a low vacancy rate, usually between 1.5% and 4%, depending on area and unit type.

This means rentals are usually easy to fill, but some neighbourhoods move slower than others.

- Very low vacancy: Centretown, Sandy Hill, Westboro

- Moderate: Orleans, Barrhaven, Riverside South

- Higher: outskirts like Rockland or Carleton Place (still healthy, just more variance)

Always budget at least 3% vacancy in your math.

6. Typical Closing Costs & Land Transfer Tax

Closing costs in Ontario are usually 1.5–4% of the purchase price.

Key items include:

- Land Transfer Tax (Ontario only – Ottawa doesn’t have the extra Toronto tax)

- Lawyer fees

- Title insurance

- Adjustments (prepaid taxes, etc.)

- Inspection fees

For a $600,000 property, you should plan for $8,000–$12,000 in total closing costs.

7. Property Taxes by Neighbourhood

Ottawa’s property taxes vary by ward and by home type.

As a rough range:

- Inner urban neighbourhoods (e.g., Glebe, Westboro): Higher assessments, similar tax rate.

- Suburbs (e.g., Barrhaven, Orleans): Slightly lower assessments, similar or lower tax impact.

- Rural outskirts (e.g., Navan, Cumberland): Lower purchase price, but sometimes higher mill rate.

Always check the tax amount, not just the price of the home – taxes directly reduce cash flow.

8. Condo Fees

Condo fees aren’t always bad, they just need to be understood.

A $260/month fee in a newer Orleans stacked condo is different from a $700/month fee in Centretown with a pool, concierge, and underground parking.

Higher fees can be okay when:

- They cover heat/water (predictable expenses)

- The reserve fund is strong

- The building is well-managed

Low fees in poorly maintained buildings often mean upcoming special assessments – which can hit hard.

You Got This!

Good investing isn’t about chasing the “perfect property.” It’s about understanding the numbers well enough that you feel in control.

Once you learn to read a deal, the fear goes away.