January: Understanding the Ottawa Real Estate Market

A Data-Driven Look at Why Ottawa’s Condo Segment is Seeing Record Choice and Stability

While the broader Ottawa housing market remains resilient, the condominium segment is currently experiencing a period of high supply. Driven by record completions and a shift in investor activity, inventory for apartments has risen to nearly eight months. This week we look at the local and national factors contributing to this trend and how it provides a more deliberate environment for both buyers and sellers to navigate their next steps.

In our commitment to putting People Over Properties, we believe that the best way to support our clients is through transparency and education. Lately, we have seen a significant divergence in the Ottawa housing market. While detached homes and townhouses remain in a relatively balanced state, the condominium segment has transitioned into a period of high supply.

To understand why this is happening, we need to look at the intersection of local inventory, provincial completions, and national economic policy.

The Numbers: A Tale of Two Markets

According to the latest data from the Ottawa Real Estate Board (OREB), the market is currently behaving quite differently depending on what you are looking to buy or sell.

Single-family homes currently sit at approximately 4.3 months of inventory (MOI), which is considered a balanced market.

Condominium apartments, however, have climbed to nearly 7.9 months of inventory.

In the real estate world, a “balanced” market usually sits between four and six months. When inventory exceeds that, it signals a period where supply is outpacing current demand, giving buyers significantly more choice and time to make decisions.

Why is Condo Inventory So High?

There are three primary drivers behind this current softness in the condo market:

Record Completions: 2025 saw a record number of new condominium and rental projects reach completion in the National Capital Region. This surge of new units hitting the market simultaneously has naturally pushed inventory levels higher than we’ve seen in years.

Investor Recalibration: Provincially and nationally, we have seen a pullback in investor activity. With carrying costs remaining higher than in previous years and rental markets beginning to stabilize, many investors are moving to the sidelines, leaving more units available for end-users.

Days on Market: The average time it takes to sell a condo in Ottawa has increased to approximately 57 days, compared to just 41 days last year. This isn’t a sign of a “stalled” market, but rather a “measured” one where buyers are doing their due diligence and prioritizing features like functional layouts and strong condo management.

The National Context: Interest Rates

On January 28, 2026, the Bank of Canada held the policy interest rate steady at 2.25%. While the rate cuts we saw throughout 2025 have provided some relief, the impact on the condo segment has been more gradual. The “wait-and-see” approach that many buyers adopted is slowly starting to thaw, but the high volume of current inventory means that there is no immediate pressure for prices to accelerate. In fact, the average price for a condo in Ottawa ended 2025 at approximately $421,253, a modest decrease of 1.4% year-over-year.

What Does This Mean for You?

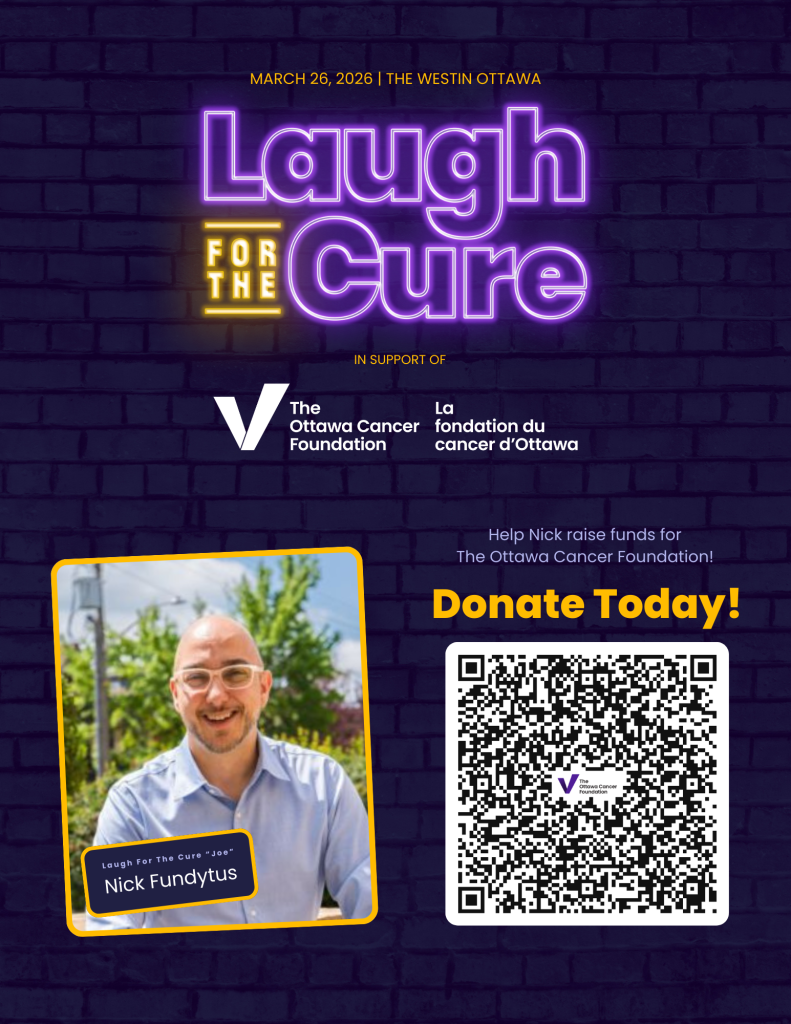

At the Nick Fundytus team, we don’t view market shifts as “good” or “bad.” We view them as opportunities to adjust strategy.

For Buyers: This is a rare window to move with deliberation. You have the leverage to request inspections, negotiate on price, and find a home that truly fits your lifestyle without the pressure of a multiple-offer scenario.

For Sellers: Success in a high-inventory market comes down to two things: presentation and pricing. Standing out requires a professional marketing strategy that highlights the unique value of your building and neighborhood.