Posted by: Nick Fundytus

Besides the core of the city, which experiences “evergreen” demand, expect the hottest areas to be those with move-in ready homes that a family can afford, such as Barrhaven, Kanata and Orleans. The coolest areas will be rurally, as Ottawans working in many sectors of the economy go back to work in the office.

The real estate market in 2023 was a rollercoaster of change, presenting unique challenges and opportunities for homebuyers and home sellers alike. As we step into 2024, understanding these trends is crucial for navigating the market effectively. My blog post today delves into the key factors that shaped Canadian and Ottawa Real Estate markets in 2023 and offers predictions of what we might expect in 2024.

My biggest four predictions are below. Let’s check back in six months to see how I did. Do you agree or disagree? Comment below!

Interest Rate Changes: The Bank of Canada’s interest rate decisions in 2023 had a significant impact on the national real estate market. Although prices in many cases came down from their early 2022 peaks, housing less affordable than ever due to higher interest rates and little rate relief until late in 2023. Fluctuating rates meant borrowing costs for homebuyers changed, affecting affordability and demand. Bank of Canada announcements provide detailed insights into these changes.

Government Trends: Federal initiatives, such as the First-Time Home Buyer Incentive played a role in 2023, helping new buyers enter the market and stimulating demand. Ultimately, however, the incentive is a band-aid on a larger problem of home shortages and resulting high prices that won’t be solved by an incentive along.

Demographic Trends: Canada’s aging population and urbanization influenced housing needs. There is a noticeable shift towards retirement properties and urban living spaces. Canada is also growing rapidly in population, primarily through immigration, and this has put pressure on home purchases and rental markets in urban areas in particular.

2024 Predictions:

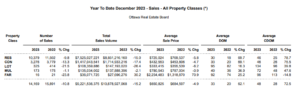

Market Overview: The two big numbers here are the Average Sale Price and and the number of homes sold in Ottawa. In 2023, the average sold price of a home of any type was $650,825, a 4.9% decrease from 2022. 14,169 Homes Sold in 2023. This was a 10.8% decrease from 2022. The sharp increase in interest rates in mid-2022 put a chill on activity in the city and a halt to runaway price trends in 2019-early 2022. In fact, these are the fewest homes sold in the city since 2006. Key numbers for the city:

Local Economic Factors: Job growth in Ottawa’s tech sector and major infrastructure projects, like the continuing LRT expansion, have had a noticeable impact on the Real Estate Landscape. For example, the Falcon Ridge project south of Ottawa’s International Airport will bring over 3000 new homes to the city in one development, and be planned from the start as a 15-minute community with transit access, shopping and entertainment all built in from the inception. Neighborhoods like Hintonburg and Little Italy, in proximity to new LRT stations, have seen increased interest from buyers, anticipating greater accessibility and future growth.

Housing Supply and Demand: The balance between supply and demand shifted as well, back to a pre-pandemic levels from the overheated market of 2019 to mid-2022. As the cost of ownership went sharply up, Buyers sat on the sidelines to save for a bigger down payment, wait for lower interest rates, or drop out of their searches. Most of Ottawa saw slight Sellers’ Market conditions for 2023. This was highlighted by the absorbtion rate of 3-4 months, meaning that if all new listings were halted, it would have taken approximately 3-4 months at the same pace of sales to sell the rest of what was already listed. During the pandemic this was often under 2 months of inventory.

Key Neighbourhoods to Watch: In 2024, areas such as Kanata, with its growing tech sector, and Barrhaven, known for its family-friendly atmosphere and new developments, are expected to be hotspots for buyers. Additionally, the continued expansion of the LRT will likely boost interest in neighborhoods like Alta Vista and Riverview Park.

2024 Predictions: Looking ahead to 2024, we anticipate a continued focus on housing affordability and supply issues. Although higher

Ottawa’s Real Estate Market is ever-moving and ever-evolving. National, provincial and local factors all play a part. Staying informed and adaptable is key. In 2024 if you are a:

1

Not the News: Newspaper and TV headlines are meant to drive clicks and subscriptions, not inform. They often cherry-pick the most sensational numbers and run with those. Focus on data-driven publications that give you the whole picture.

2

CMHC: The Canadian Mortgage and Housing Corporation keeps great stats and publishes data-driven, nonpartisan reports to keep you informed on market trends in Ottawa and the rest of Canada.

3

Bank of Canada: Interest rates are a key factor in housing affordability. Instead of listening to someone’s predictions about rates, why not see what the BoC is saying themselves?

DROP US A LINE

Email us any time

nick@nickfundytus.ca

GIVE US A SHOUT

Nick: (613) 400-2000

Office: (613) 238-2801